tesla model y tax credit 2020

Since 2010 anyone purchasing a qualified electric vehicle including any new Tesla model has been eligible to receive a 7500 federal. Media New media Search media.

2020 Tesla Model Y Red Matchbox Mbx 2022 Mb1280 Short Card 1 64 Toy Car Ebay

The current proposed legislation has many.

. The current federal tax credit for which Tesla no longer qualifies has no limit on the price. Blog Hot New Questions Forums Tesla Model S Model 3 Model X Model Y Roadster 2008-2012 Roadster 202X Cybertruck SpaceX. Xcel Energy offers income qualified customers 5500 rebate for new and 3000 rebate for used eligible electric vehicles.

It was 1875. Any vehicles purchased after that date are no. One Tesla that should qualify for the federal Clean Vehicle Tax Credit in 2023 is the Tesla Model 3 which would have been the Model E if Ford hadnt snapped up the snappy.

The incentive amount is equivalent to a percentage of the eligible costs. The credit ranges between 2500 and 7500 depending on the capacity of the battery. Luckily Teslas Model Y vehicles are classified as SUVs and will also classify under the truck vans and SUV portion of the tax credit.

Jan 01 2020 at 300am ET. Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. Tax Credit and Model Y delivery.

Model Y received the IIHS Top Safety Pick award with top ratings in all crashworthiness and front crash prevention categories. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. The Tesla Team August 10 2018.

Mental health practitioner interview questions and answers. This nonrefundable credit is calculated by a. March 14 2022 528 AM.

The 2020 Tesla Model Y True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership. Based on the Model 3 sedan the Tesla Model Y is a battery electric. 1 Best answer.

The Federal Tax Credit will apply to the cost of the solar portion of Solar Roof as well as the cost of Powerwall. The credit begins to phase out for a manufacturer when that manufacturer sells. Beginning on January 1 2022.

Electric Vehicles Solar and Energy Storage. Safety is the most important part of every Tesla. For vehicles acquired after 12312009.

The IRS tax credit for 2022 ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Local and Utility Incentives. The Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit.

Today January 1 2020 with the beginning of a new quarter there is no federal tax credit available for new Tesla cars sold in the US. Since SUVs can cost up to 80000 USD and.

Pre Owned 2020 Tesla Model Y Long Range Suv In North Little Rock 10172 Evolve Auto

Tesla Model Y Performance Vs Jaguar I Pace Current Automotive

We Take A Look At The New Ev Tax Credit And Which Teslas Qualify

Used Tesla Model Y For Sale In Minneapolis Mn Cargurus

Used Tesla Model Y For Sale With Photos Cargurus

Tesla Lowers Model Y Price To 51 190 Raises Price On Autopilot

Chevy S New Electric Suv Costs Less Than 50 Of Tesla S Model Y And The Difference In Quality Is Slim To None The Us Sun

Tesla Model Y Makes Up Over Half Of Tesla S California Registrations To End 2020 Cnet

True Cost Of The Tesla Model Y Full Breakdown Of Costs Daniel S Brew

Used 2020 Tesla Model Y For Sale Near Me Cars Com

2020 Tesla Model Y Review Autotrader

2020 Tesla Model Y Performance Awd Prices Values Model Y Performance Awd Price Specs Nadaguides

The Tesla Model Y Is Gaining Ground Frighteningly Quickly In Ca S General Auto Market

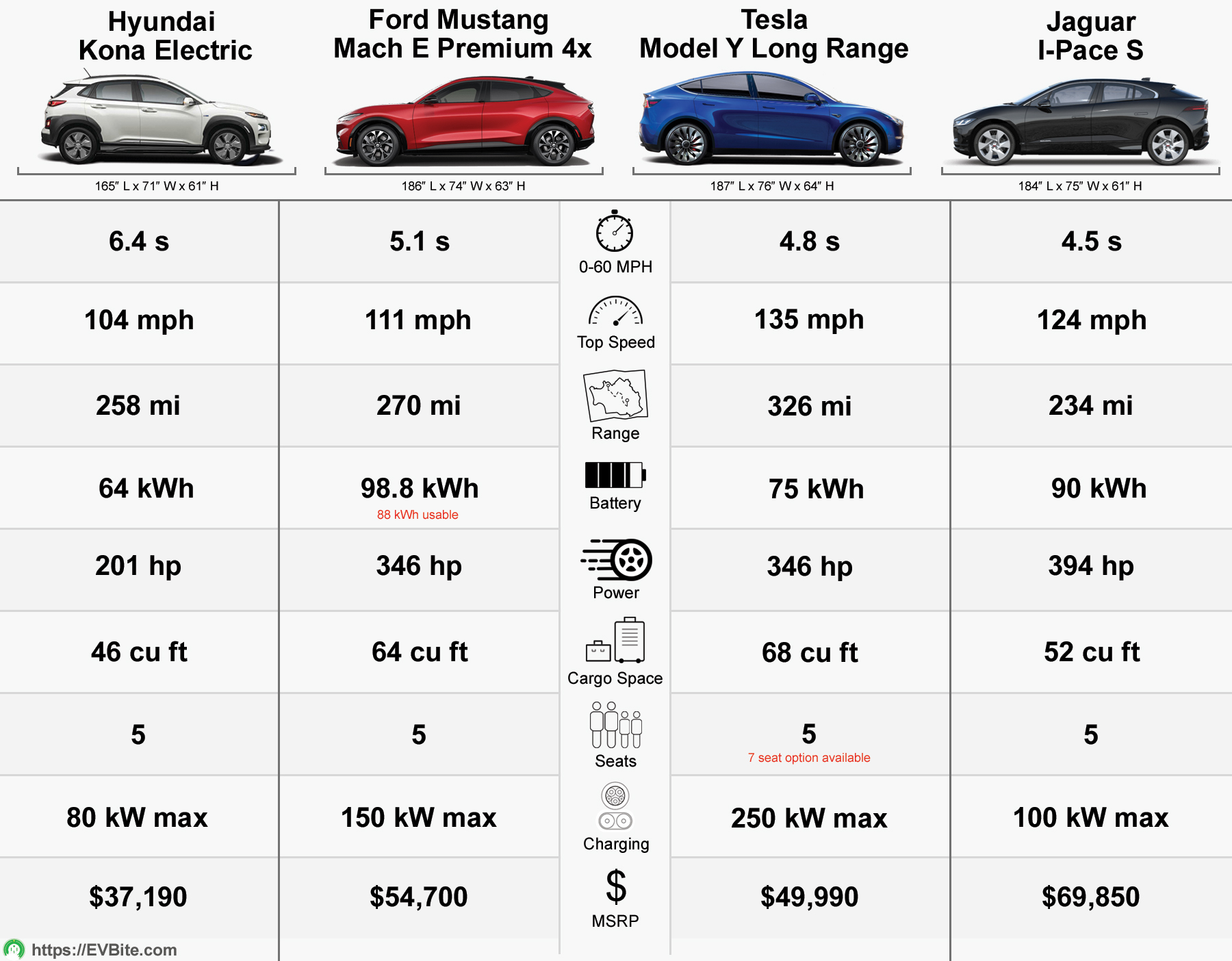

The 10 Tesla Model Y Competitors The Best Electric Crossovers In 2020

Cheaper Tesla Model Y Standard Range And A New Three Row Seat Option Unveiled